Meeting of Municipalities on May 28th anticipates debates of the July summit.

Amid a global landscape of rapid and intense transformations in trade and geopolitical dynamics, Rio de Janeiro is set to host the BRICS International Forum of Municipalities next week. The event, scheduled for May 28, will precede the highly anticipated BRICS summit taking place in July, also in the iconic city.

Following the United States’ tariff hikes, which disrupted the global trade order and compelled countries across all continents to rethink their commercial and diplomatic strategies, the BRICS bloc has emerged with unprecedented visibility on the world stage. The recent visit of President Luiz Inácio Lula da Silva to China and Russia, accompanied by a substantial delegation of ministers and business leaders, has only heightened expectations for the series of meetings Brazil is set to host.

“The BRICS International Forum of Municipalities is a platform for communication and business, promoting the exchange of experiences, ideas, and opportunities among representatives of regional and municipal governments, as well as the business and investment communities from BRICS countries,” explains the official document of the event. It also notes that the forum has been part of the official annual agenda of the bloc’s presiding countries since 2020.

Municipalities as protagonists

The concept of “BRICS municipalities,” widely discussed in Russia, is gaining traction in Brazil with this event. The initiative enables Brazilian cities—particularly Rio de Janeiro—to engage directly with investors and municipal governments in BRICS member countries, bypassing the need for federal mediation.

Eduardo Paes, mayor of Rio de Janeiro and president of the National Front of Mayors, leads the local organizing committee. “Our goal is to strengthen ties among BRICS countries through a city-centric approach,” states the event’s preparatory document.

The event is expected to draw over 700 participants, including 150 mayors from BRICS countries, 150 Brazilian mayors, and 150 representatives from investment funds, financial institutions, and business associations. This gathering represents a unique opportunity to forge partnerships that could lead to direct investments, job creation, and economic growth for Brazilian municipalities.

Strategic themes under debate

The agenda includes critical topics for municipal development, such as the future of smart cities, public safety management, urban data integration, urban renewal through public-private partnerships, tourism and regional integration, sustainable development, and food security.

A key highlight will be the session on municipal infrastructure, which will explore project planning, capital raising, operations, and funding opportunities—an especially pertinent issue for Brazilian cities facing fiscal constraints in executing major structural projects.

The conclusions drawn from the meeting will be compiled into an official statement to be submitted to the BRICS presidential summit, scheduled for July 6–7, also in Rio. This linkage underscores the strategic relevance of the municipal forum as groundwork for high-level diplomatic discussions.

July Summit: High Expectations

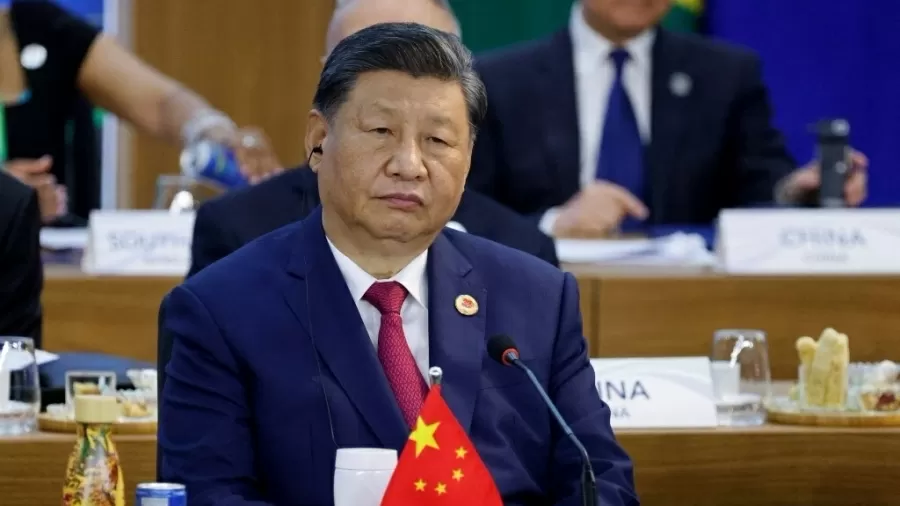

The BRICS summit in July, set to take place at the Museum of Modern Art (MAM) in Rio de Janeiro, has already confirmed the presence of Chinese President Xi Jinping, alongside leaders of other member states. The summit is expected to welcome around 4,000 participants, including heads of state and delegations from more than 40 nations.

Brazil’s decision to host these gatherings comes at a moment of shifting global alliances. As protectionist policies intensify in traditional economies and tensions rise between Western and Eastern powers, the BRICS bloc—comprising Brazil, Russia, India, China, and South Africa—has emerged as a counterweight promoting a multipolar international system.

The bloc’s recent expansion—with the inclusion of Egypt, Ethiopia, Iran, Saudi Arabia, and the United Arab Emirates—has further elevated its economic and geopolitical stature. Collectively, BRICS countries now account for over 40% of the global population and roughly a quarter of the world’s GDP.

Opportunities for Brazil

For Brazil, currently holding the rotating presidency of the bloc, these events provide a chance to assert itself as a global mediator and to attract direct investments into its municipalities. The municipal diplomacy strategy, to be tested at next week’s forum, could open avenues for partnerships traditionally brokered at the federal level.

“This special edition allows us to address key topics for the upcoming BRICS summit in July,” notes the preparatory document for the municipal meeting, emphasizing the strategic alignment between the two events.

To support the logistics and ensure security during the July summit, the Rio City Hall has declared a municipal holiday on Monday, July 7, the second day of the event.

This is a particularly timely opportunity for Brazil, which is actively working to diversify its trade relations and attract investments in infrastructure, renewable energy, and technology. Closer engagement with powerful emerging economies like China and India may offer alternatives to traditional Western partnerships, especially in today’s volatile global trade environment.

All eyes will be on Rio de Janeiro in the coming weeks to observe how Brazil navigates these critical diplomatic events and what concrete outcomes may emerge for the nation’s economic and municipal development.

***

LEARN MORE ABOUT THE EVENT

BRICS INTERNATIONAL FORUM OF MUNICIPALITIES 2025: BRAZIL

Date: May 28, 2025

Time: 9:30 a.m. to 7:30 p.m.

Location: EXPOMAG – Rio de Janeiro

PROGRAM

MAIN AUDITORIUM

9:30 a.m. – 11:00 a.m.: Official Opening – Opening ceremony marking the start of a new cooperation agenda between BRICS+ territories

6:00 p.m. – 7:30 p.m.: Official Closing – Reflections on the event and reading of the Forum Declaration for submission to the presidential summit

SESSION ROOM 1

12:00 p.m. – 1:30 p.m.: The Future of Smart Cities in BRICS+: Smart surveillance, public security management, and urban data integration

2:00 p.m. – 3:30 p.m.: Proptechs, PPPs, and the Future of Urban Requalification

4:00 p.m. – 5:30 p.m.: Tourism and Regional Integration – Building connections between BRICS+ regions

SESSION ROOM 2

12:00 p.m. – 1:30 p.m.: Sustainable Development in BRICS+ Cities: Food security and ESG

2:00 p.m. – 3:30 p.m.: Partners Session

4:00 p.m. – 5:30 p.m.: Dialogue of Tomorrow’s Leaders for the Sustainable Development of BRICS – Youth Parliamentarians’ Perspectives

SESSION ROOM 3

12:00 p.m. – 1:30 p.m.: Development of Municipal Infrastructure – Design, fundraising, and operations. Funding opportunities

2:00 p.m. – 3:30 p.m.: Partners Session – Social Development

4:00 p.m. – 5:30 p.m.: Partners Session – Energy

EXPECTED AUDIENCE

Total expected attendance: Approximately 400 people

150 BRICS Mayors

150 Brazilian Mayors

150 Representatives from Investment Funds, Financial Institutions, and Investment Agencies

Business delegations

Influencers, media, and public figures

CONTACT

Email (Brazil): brazil@imbrics.moscow

Phone: +55 31 98282-1342 (Wagner Pereira – Sponsorship Packages)

Official website: imbrics.moscow